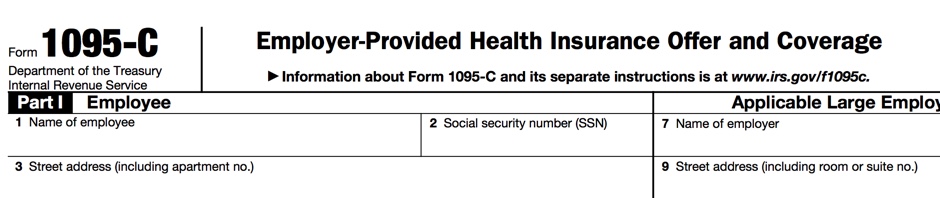

IRS Form 1095-C is used to report employee information.

This post will provide you with some additional information regarding Part II of the IRS Form

1095-C. Specifically, the codes and amounts to be entered on lines 14, 15, and 16.

First off, if an employee was full-time for any month during the year, then you will need to prepare a 1095-C for them.

Line 15 deals with coverage offered to the employee during the year. A code MUST be entered for each month during the year or the all 12 months box needs to be completed. Even if they were only employed for one month during the year, all months need to have a code entered for them.

The following is not a complete listing of all the codes and when they would be used, but it probably covers most cases. As always, you should carefully review all the codes and select the one that most appropriately applies in your case.

LINE 14

1A - If you offered coverage to the employee, dependents (if any), and spouse (if any) and the cost was less than 9.5% of the Federal poverty level for the 48 contiguous USA, then enter this code. For 2015, the Federal poverty level for a family of 1 is $ 11,770. This converts to a monthly amount of

$ 93.18. ( $ 11,770 / 12 X .095 = $ 93.18 )

1H - Use this code if the employee was not employed or if they were employed but not eligible for coverage due to a waiting period.

1B, 1C, 1D, 1E - Use the appropriate code that indicates the coverage offered when the cost exceeds 9.5% of the Federal poverty level for the 48 contiguous USA. If the employee cost exceeds $ 93.18 per month, then you would use one of these codes. If you have an employee that elects cobra coverage or Medicare, then you would select one of these codes.

LINE 15

If the amount being charged for their coverage exceeds the Federal poverty level as explained above, then you would enter the cost for minimum essential coverage for just the employee.

If you entered 1A on line 14, then you do not need to complete line 15. Obviously, if you used 1B, 1C, 1D, or 1E, then you would enter an amount on line 15.

LINE 16

Line 16 is an optional entry and is provided as a way to avoid inquires by the IRS in certain circumstances.

2A - If you entered 1H on line 14, then you would in most cases enter 2A on line 16.

2B - User this code if the employee was terminated during the month and their coverage ended before the end of the month.

2C - If you entered 1A, 1B, 1C, 1D, 1E on line 14, you would enter 2C on line 16.

2D - If you entered 1H on line 14 because the employee was not offered coverage during the waiting period to become eligible, then you would enter 2D on line 16.

One final thing to keep in mind, code 2C on line 16 trumps all other codes, so it that code fits, use it rather than any other code.

No comments:

Post a Comment