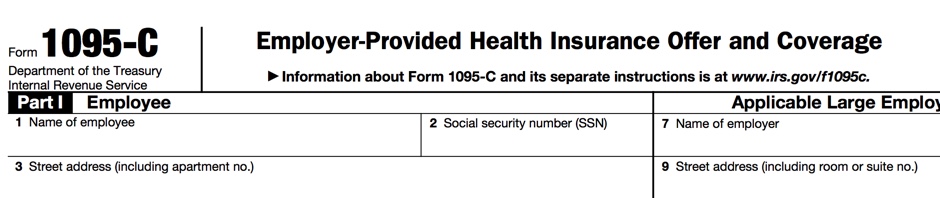

IRS Form 1095-C is used to report employee information.

This post will provide you with some additional information regarding Part II of the IRS Form

1095-C. Specifically, the codes and amounts to be entered on lines 14, 15, and 16.

First off, if an employee was full-time for any month during the year, then you will need to prepare a 1095-C for them.

Line 15 deals with coverage offered to the employee during the year. A code MUST be entered for each month during the year or the all 12 months box needs to be completed. Even if they were only employed for one month during the year, all months need to have a code entered for them.

The following is not a complete listing of all the codes and when they would be used, but it probably covers most cases. As always, you should carefully review all the codes and select the one that most appropriately applies in your case.

LINE 14

1A - If you offered coverage to the employee, dependents (if any), and spouse (if any) and the cost was less than 9.5% of the Federal poverty level for the 48 contiguous USA, then enter this code. For 2015, the Federal poverty level for a family of 1 is $ 11,770. This converts to a monthly amount of

$ 93.18. ( $ 11,770 / 12 X .095 = $ 93.18 )

1H - Use this code if the employee was not employed or if they were employed but not eligible for coverage due to a waiting period.

1B, 1C, 1D, 1E - Use the appropriate code that indicates the coverage offered when the cost exceeds 9.5% of the Federal poverty level for the 48 contiguous USA. If the employee cost exceeds $ 93.18 per month, then you would use one of these codes. If you have an employee that elects cobra coverage or Medicare, then you would select one of these codes.

LINE 15

If the amount being charged for their coverage exceeds the Federal poverty level as explained above, then you would enter the cost for minimum essential coverage for just the employee.

If you entered 1A on line 14, then you do not need to complete line 15. Obviously, if you used 1B, 1C, 1D, or 1E, then you would enter an amount on line 15.

LINE 16

Line 16 is an optional entry and is provided as a way to avoid inquires by the IRS in certain circumstances.

2A - If you entered 1H on line 14, then you would in most cases enter 2A on line 16.

2B - User this code if the employee was terminated during the month and their coverage ended before the end of the month.

2C - If you entered 1A, 1B, 1C, 1D, 1E on line 14, you would enter 2C on line 16.

2D - If you entered 1H on line 14 because the employee was not offered coverage during the waiting period to become eligible, then you would enter 2D on line 16.

One final thing to keep in mind, code 2C on line 16 trumps all other codes, so it that code fits, use it rather than any other code.

The purpose of this blog is to provide details about the information reports (1094-B / 1095-B and 1094-C and 1095-C) mandated by the Affordable Care Act. In addition, we will also provide information about our software application, ACA 1095 Reporting, and how it can assist you in meeting these reporting requirements.

IRS Form 1095-C

Wednesday, July 29, 2015

Monday, July 27, 2015

Lowered Expectations from the IRS

In a recent article, "IRS Scales Back to Absorb Funding Cuts", the author describes how the budget cutbacks in 2014 and 2015 are affecting the ability of the IRS to respond to taxpayer's questions and request for assistance.

If you are the one asking the question, this may be a bad thing, but if you are the one not getting audited, then that could be a very good thing. One thing is clear, don't expect too much assistance from the IRS.

Here's a perfect example. After watching a webinar regarding the Affordable Care Act Information Returns filing process, I submitted an email to the AIR mailbox regarding inconsistencies and other issues that I discovered in the presentation material. In all, there were six questions submitted. The email was sent on June 23, 2015. On June 29th, I received a reply where they answered 4 of my questions.

On July 22, they answered one of the remaining two unanswered questions. Actually, they didn't answer a question as much as agreed to an inconsistency that existed in one of the draft publications and stated that it would be corrected before the publication was finalized. They also acknowledged the remaining unanswered question would require more research.

So what is the remaining unanswered question that requires so much research?

The question concerned the AIR Submission and Composition and Reference Guide, that is supposed to provide software developers and other transmitters with specifics regarding how to send e-filed ACA data files to the IRS. Yes, the information is very specific because failure to follow these guidelines will result in your submission being rejected.

One section has to do with the naming of the data files that are submitted through the e-file system. They did a very good job of explaining the pertinent parts of the file naming convention except for the last 4 digits in the filename which were "000Z".

We could assume that this is an indication that the time stamp that is part of the filename is to be the local time on the user's computer, and the "000Z" is an hour and minute offset to zulu time in the format of HHMM. However, with the IRS, you never make assumptions, this I asked the following question.

If you are the one asking the question, this may be a bad thing, but if you are the one not getting audited, then that could be a very good thing. One thing is clear, don't expect too much assistance from the IRS.

Here's a perfect example. After watching a webinar regarding the Affordable Care Act Information Returns filing process, I submitted an email to the AIR mailbox regarding inconsistencies and other issues that I discovered in the presentation material. In all, there were six questions submitted. The email was sent on June 23, 2015. On June 29th, I received a reply where they answered 4 of my questions.

On July 22, they answered one of the remaining two unanswered questions. Actually, they didn't answer a question as much as agreed to an inconsistency that existed in one of the draft publications and stated that it would be corrected before the publication was finalized. They also acknowledged the remaining unanswered question would require more research.

So what is the remaining unanswered question that requires so much research?

The question concerned the AIR Submission and Composition and Reference Guide, that is supposed to provide software developers and other transmitters with specifics regarding how to send e-filed ACA data files to the IRS. Yes, the information is very specific because failure to follow these guidelines will result in your submission being rejected.

One section has to do with the naming of the data files that are submitted through the e-file system. They did a very good job of explaining the pertinent parts of the file naming convention except for the last 4 digits in the filename which were "000Z".

We could assume that this is an indication that the time stamp that is part of the filename is to be the local time on the user's computer, and the "000Z" is an hour and minute offset to zulu time in the format of HHMM. However, with the IRS, you never make assumptions, this I asked the following question.

3. Section 3.2 has a filename format and two sample file names. However, the timestamp in both of the examples is shown as 010102000Z. The time portion of a timestamp is normally HHMMSS which relates to the 010102, so what is the 000Z that is added to the end of it?

Evidently, this was a much more complicated question than I thought because two days before e-file testing starts (July 29th, 2015) for the voluntary 2014 year, we are still waiting for a reply to this question.

Friday, July 17, 2015

Timetable for e-file testing?

One of the questions we get asked is if we are certified to e-file returns?

No, not yet. In fact, no one is and they won't be until December, 2015. Here is the e-file testing timetable as explained to us in a recent webinar that the IRS conducted.

Employers and other organizations can voluntarily file ACA information returns for 2014. The due date for these returns is October 15, 2015. Why are the 2014 return due ten months after the end of the filing year and the 2015 returns due three months (March 31, 2016) after the end o the filing year. I can only conclude that it's because the IRS is so far behind in getting the process for filing, especially e-filing, these information returns.

Before you can e-file "voluntary" 2014 returns, you must go through a testing and certification process. This consists of submitting various test data based on scenario's provided by the IRS. If the e-filed data passes validation, then you get certified.

The testing dates for 2014 returns is supposed to begin July 29, 2015. I say "supposed to begin" because before you can participate in the testing process, you need to get a TCC (Transmitter Control Code). We applied for ours the day after the application became available and over two weeks later, we still don't have it. When I placed a call to the IRS to inquire about the status of our application, they stated that it could take up to 45 days to get the TCC. Strange that they wouldn't make the application available 45 days prior to the beginning of testing, but if I had a nickel for every strange thing that the IRS did... well... let's just say I wouldn't be writing this blog post.

Testing for the 2015 year is not schedule to start until November, 2015. Based on the time it's been taking the IRS to get this process rolling, allowing just five months until returns are due may not be enough.

No, not yet. In fact, no one is and they won't be until December, 2015. Here is the e-file testing timetable as explained to us in a recent webinar that the IRS conducted.

Employers and other organizations can voluntarily file ACA information returns for 2014. The due date for these returns is October 15, 2015. Why are the 2014 return due ten months after the end of the filing year and the 2015 returns due three months (March 31, 2016) after the end o the filing year. I can only conclude that it's because the IRS is so far behind in getting the process for filing, especially e-filing, these information returns.

Before you can e-file "voluntary" 2014 returns, you must go through a testing and certification process. This consists of submitting various test data based on scenario's provided by the IRS. If the e-filed data passes validation, then you get certified.

The testing dates for 2014 returns is supposed to begin July 29, 2015. I say "supposed to begin" because before you can participate in the testing process, you need to get a TCC (Transmitter Control Code). We applied for ours the day after the application became available and over two weeks later, we still don't have it. When I placed a call to the IRS to inquire about the status of our application, they stated that it could take up to 45 days to get the TCC. Strange that they wouldn't make the application available 45 days prior to the beginning of testing, but if I had a nickel for every strange thing that the IRS did... well... let's just say I wouldn't be writing this blog post.

Testing for the 2015 year is not schedule to start until November, 2015. Based on the time it's been taking the IRS to get this process rolling, allowing just five months until returns are due may not be enough.

Tuesday, July 14, 2015

How are information returns e-filed?

If you are familiar with e-filing other tax documents, then you know about FIRE. That stands for Filing Information Returns Electronically. Here is a link that tells you more about the FIRE system, but before you get too excited about it, you should know that the IRS is not using FIRE for Affordable Care Act (ACA) information returns.

File Information Returns Electronically

For some reason, the IRS decided that they needed a new system - AIR (Affordable-Care-Act Information Returns) - to handle these particular information returns.

Here is a link to the IRS's AIR page. It has additional links explaining how the system works.

AIR

If you take the time to review the documents that are linked on the above AIR webpage, it won't take you long to appreciate how complex e-filing ACA information returns will be. And remember, if you have to file more than 250 1095-B or 1095-C returns, then you are required to e-file. The IRS is also encouraging e-filing even if you aren't required to.

The e-filing requirements are very complex and some companies may assume that they can just submit their own data files to the IRS; and they can, but first they have to do the following. This assumes that they have the data that need to be submitted in an appropriate source file - this could be a database application, Excel, or a third party software application like our own ACA 1095 Software.

Here is where things start to get really complex.

1. Unlike FIRE (remember that e-filing system), data files have to conform to an XML format specified by the IRS. In fact, you have to go through a testing process before you can be approved to create the XML files for submission.

2. You must have an e-services account setup with the IRS. An e-services account is specifically for e-filing documents with the IRS.

3. You must have a TCC (Transmission Control Code) issued by the IRS. The TCC is included in a manifest file that is submitted with the data file that contains the information about your company and employees.

After you've done the above three things, you then have two ways to submit your XML data files.

1. UI - This is a website that you will log into and then upload your XML data files by selecting them from your computer.

2. A2A - This is a more sophisticated of submitting your data and does not require any interaction on your part. It uses a web services approach to transmit the data.

If your data files are not accepted - it could be because the XML data is malformed - then you will need to correct the XML data files and resubmit.

If they are initially accept, you may have errors that will need to be corrected by re-submitting the corrected data using one of the two methods described above.

I have been intentionally brief here because trying to cover all the information related to e-filing would take a considerable amount of space. In fact, if you look at all the publications that are linked on the IRS's AIR webpage, included the instructions for the forms that need to be submitted, you'll have to wade through hundreds of pages.

As you can see, e-filing ACA information returns is very complex.

Here is one more thing you need to pay particular attention to. An e-services account is issued to an individual, not an organization, so if you want to submit your own data, you're going to have to ask someone to provide very private information in the application for the e-services account. Here is a list of the information they have to provide.

File Information Returns Electronically

For some reason, the IRS decided that they needed a new system - AIR (Affordable-Care-Act Information Returns) - to handle these particular information returns.

Here is a link to the IRS's AIR page. It has additional links explaining how the system works.

AIR

If you take the time to review the documents that are linked on the above AIR webpage, it won't take you long to appreciate how complex e-filing ACA information returns will be. And remember, if you have to file more than 250 1095-B or 1095-C returns, then you are required to e-file. The IRS is also encouraging e-filing even if you aren't required to.

The e-filing requirements are very complex and some companies may assume that they can just submit their own data files to the IRS; and they can, but first they have to do the following. This assumes that they have the data that need to be submitted in an appropriate source file - this could be a database application, Excel, or a third party software application like our own ACA 1095 Software.

Here is where things start to get really complex.

1. Unlike FIRE (remember that e-filing system), data files have to conform to an XML format specified by the IRS. In fact, you have to go through a testing process before you can be approved to create the XML files for submission.

2. You must have an e-services account setup with the IRS. An e-services account is specifically for e-filing documents with the IRS.

3. You must have a TCC (Transmission Control Code) issued by the IRS. The TCC is included in a manifest file that is submitted with the data file that contains the information about your company and employees.

After you've done the above three things, you then have two ways to submit your XML data files.

1. UI - This is a website that you will log into and then upload your XML data files by selecting them from your computer.

2. A2A - This is a more sophisticated of submitting your data and does not require any interaction on your part. It uses a web services approach to transmit the data.

If your data files are not accepted - it could be because the XML data is malformed - then you will need to correct the XML data files and resubmit.

If they are initially accept, you may have errors that will need to be corrected by re-submitting the corrected data using one of the two methods described above.

I have been intentionally brief here because trying to cover all the information related to e-filing would take a considerable amount of space. In fact, if you look at all the publications that are linked on the IRS's AIR webpage, included the instructions for the forms that need to be submitted, you'll have to wade through hundreds of pages.

As you can see, e-filing ACA information returns is very complex.

Here is one more thing you need to pay particular attention to. An e-services account is issued to an individual, not an organization, so if you want to submit your own data, you're going to have to ask someone to provide very private information in the application for the e-services account. Here is a list of the information they have to provide.

We ask you to provide the following information to become a registered user:

- Legal name (verified with IRS & SSA records)

- Social Security Number (verified with SSA records)

- Date of birth (verified with SSA records)

- Telephone number

- E-mail address

- Adjusted Gross Income (AGI) from either your current year or prior year filed tax return (verified from IRS records)

- Username. Select your preferred username. Please read the rules for selecting your username

- Password and PIN. Select your password and PIN. Please read the helpful hints on selecting a secure, unique password and PIN

- Reminder question to recover a forgotten username

- Home mailing address (verified from IRS records). If you have moved since you last transacted with the IRS, please update your information when registering

This seems to be a huge deterrent to any company that wants to e-file their own data instead of using a third party vendor to handle this for them.

By the way, the FIRE system did not require an e-services account. Why the IRS decided to link a TCC with an e-services account is a question we asked, but have not been provided an answer for.

Where can I find out more details about the Affordable Care Act information returns, due dates, etc.?

We cover a lot of this information on a special website that we created just for this purpose. Here is the link.

Affordable Care Act Information Returns

Rather than duplicate all the information included there, I would refer you to that website and then we can deal with other issues that you will no doubt have questions about.

Affordable Care Act Information Returns

Rather than duplicate all the information included there, I would refer you to that website and then we can deal with other issues that you will no doubt have questions about.

What are Affordable Care Act Information Returns?

The Affordable Care Act (ACA) created new reporting requirements based on health care provided to employees in 2015. Most employers may be completely unaware that these new reporting requirements are mandated by some very hefty fines, and worse yet, attempting to gather the information that needs to be reported to the IRS after-the-fact may be much more complicated and expensive than spending a few minutes each month keeping the information updated and accurate.

New blog location!

That's a big fat OOPS!

Our original location for this blog was on blog.com; but they appear to have disappeared from the web because we can no longer access their site or update our blog.

We are starting over on a new web hosting site. Sorry for the inconvenience.

Our original location for this blog was on blog.com; but they appear to have disappeared from the web because we can no longer access their site or update our blog.

We are starting over on a new web hosting site. Sorry for the inconvenience.

Subscribe to:

Posts (Atom)