File Information Returns Electronically

For some reason, the IRS decided that they needed a new system - AIR (Affordable-Care-Act Information Returns) - to handle these particular information returns.

Here is a link to the IRS's AIR page. It has additional links explaining how the system works.

AIR

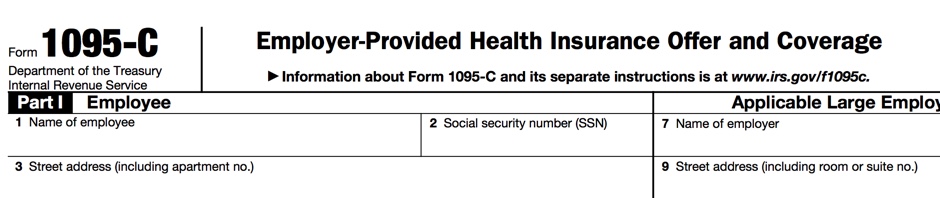

If you take the time to review the documents that are linked on the above AIR webpage, it won't take you long to appreciate how complex e-filing ACA information returns will be. And remember, if you have to file more than 250 1095-B or 1095-C returns, then you are required to e-file. The IRS is also encouraging e-filing even if you aren't required to.

The e-filing requirements are very complex and some companies may assume that they can just submit their own data files to the IRS; and they can, but first they have to do the following. This assumes that they have the data that need to be submitted in an appropriate source file - this could be a database application, Excel, or a third party software application like our own ACA 1095 Software.

Here is where things start to get really complex.

1. Unlike FIRE (remember that e-filing system), data files have to conform to an XML format specified by the IRS. In fact, you have to go through a testing process before you can be approved to create the XML files for submission.

2. You must have an e-services account setup with the IRS. An e-services account is specifically for e-filing documents with the IRS.

3. You must have a TCC (Transmission Control Code) issued by the IRS. The TCC is included in a manifest file that is submitted with the data file that contains the information about your company and employees.

After you've done the above three things, you then have two ways to submit your XML data files.

1. UI - This is a website that you will log into and then upload your XML data files by selecting them from your computer.

2. A2A - This is a more sophisticated of submitting your data and does not require any interaction on your part. It uses a web services approach to transmit the data.

If your data files are not accepted - it could be because the XML data is malformed - then you will need to correct the XML data files and resubmit.

If they are initially accept, you may have errors that will need to be corrected by re-submitting the corrected data using one of the two methods described above.

I have been intentionally brief here because trying to cover all the information related to e-filing would take a considerable amount of space. In fact, if you look at all the publications that are linked on the IRS's AIR webpage, included the instructions for the forms that need to be submitted, you'll have to wade through hundreds of pages.

As you can see, e-filing ACA information returns is very complex.

Here is one more thing you need to pay particular attention to. An e-services account is issued to an individual, not an organization, so if you want to submit your own data, you're going to have to ask someone to provide very private information in the application for the e-services account. Here is a list of the information they have to provide.

We ask you to provide the following information to become a registered user:

- Legal name (verified with IRS & SSA records)

- Social Security Number (verified with SSA records)

- Date of birth (verified with SSA records)

- Telephone number

- E-mail address

- Adjusted Gross Income (AGI) from either your current year or prior year filed tax return (verified from IRS records)

- Username. Select your preferred username. Please read the rules for selecting your username

- Password and PIN. Select your password and PIN. Please read the helpful hints on selecting a secure, unique password and PIN

- Reminder question to recover a forgotten username

- Home mailing address (verified from IRS records). If you have moved since you last transacted with the IRS, please update your information when registering

This seems to be a huge deterrent to any company that wants to e-file their own data instead of using a third party vendor to handle this for them.

By the way, the FIRE system did not require an e-services account. Why the IRS decided to link a TCC with an e-services account is a question we asked, but have not been provided an answer for.

No comments:

Post a Comment